Skip to content

High fees for tier 3 tokens where 10-100x price jump resulted in corresponding fees growth before we figure this out and fix. Dormant accounts fees were also negative contributors, so we removed them.Weak IEO results. As the largest primary market for digital assets in the world with 170+ IEOs since 2017 we make it easy for entrepreneurs to connect with investors. Do not take it wrong, we do not sell or make investment advise. That is not an exchange business - we must be neutral. Most of startups would fail to be attractive for investors. Anyway, some entrepreneurs expect to pay 2 BTC and get 20 BTC back. Why? Is it their competence or our sales managers solicitation? How would we control communications with prospects of a hundred sales ambassadors? We made IEO service free of charge in 2019 and such conflicts calmed down.Blackmailing activity (pay me or I will spread negative reviews real or libels)

Star Blast Pressure of Trading and Bubbles

Star Blast Pressure of Trading and Bubbles

Traders manage the planet. Trading makes people stakeholders of the future. That is not easy and painful for newbies traders. Thus there are unhappy traders and high load pressure. Are you comfortable to leverage high load pressure for creativity?

Trading makes people stakeholders of the future. Traders and investors are the global brain predicting the future and optimising resource allocation to maximize cash flows and stock prices growth. Stock prices change means change in workforce allocation. Change in stocks prices impact product prices, labour prices, education prices and even dating market “prices”. This price contagion or price transmission through markets optimize goals, values, feelings and actions of billions to maximise humankind future output.

The reason why you read this text via large screen of mobile device is because of investors who envisioned you with this device a decade ago.

New traders often start like gamblers and loose money to those who are trained to predict the future market share and cash flows of traded companies.

Todays’ decisions of politicians, regulators and firms impact economy performance in some years. Some of the newbies start to connect the dots: how todays news impact the value of stocks in their portfolio and wellbeing. They start to see the future now and act as stakeholders to make it better. They are a better educated voters, so politicians have less chance to fool them.

55% of adult US population bought stocks in 2019 only. This number is between 0 to 5% in other countries and we have a lot of work to educate and help people to become stakeholders of the humankind future.

All trading apps has less positive reviews comparing to banking apps

Trading app 2.1 avg vs Banking apps 4.2 avg Trustpilot

It is not only about crypto, the largest trading app Robinhood has 1.8 Trustpilot review, while valued at .

LATOKEN has a better outlook as we strive to make the best support service and product

Yet, most of scam mentions are to speedup customer support to push KYC forward or restore access to account frozen due to suspicious activity (such as password brut force attacks). After the issue is resolved, a client would unlikely to remove negative tweet or review.

Other categories of negative mentions by order of magnitude:

We have close to 1 million accounts and 474 “latoken scam” mentions in google. It does not mean that we have 474 legal cases. Binance does not have 19 900 legal cases.

In crypto Scam often have a meaning of an adjective intended to attract attention to negative feelings like “fuck, it does not work well”. In fiat world the word “scam” mentioned against a company often trigger criminal investigation against company or a libel lawsuit against the claimant.

In google search results “Binance scam” is mentioned 19 900 times vs 20 million “Binance” or 0.1% . “LATOKEN scam” is mentioned 474 times vs 1 million “LATOKEN” or 0.047% negative mention ratio.

Crypto trading industry after the bubble means market full of conflicts, scandals and pressure needed to give a birth to new era of internet of value.

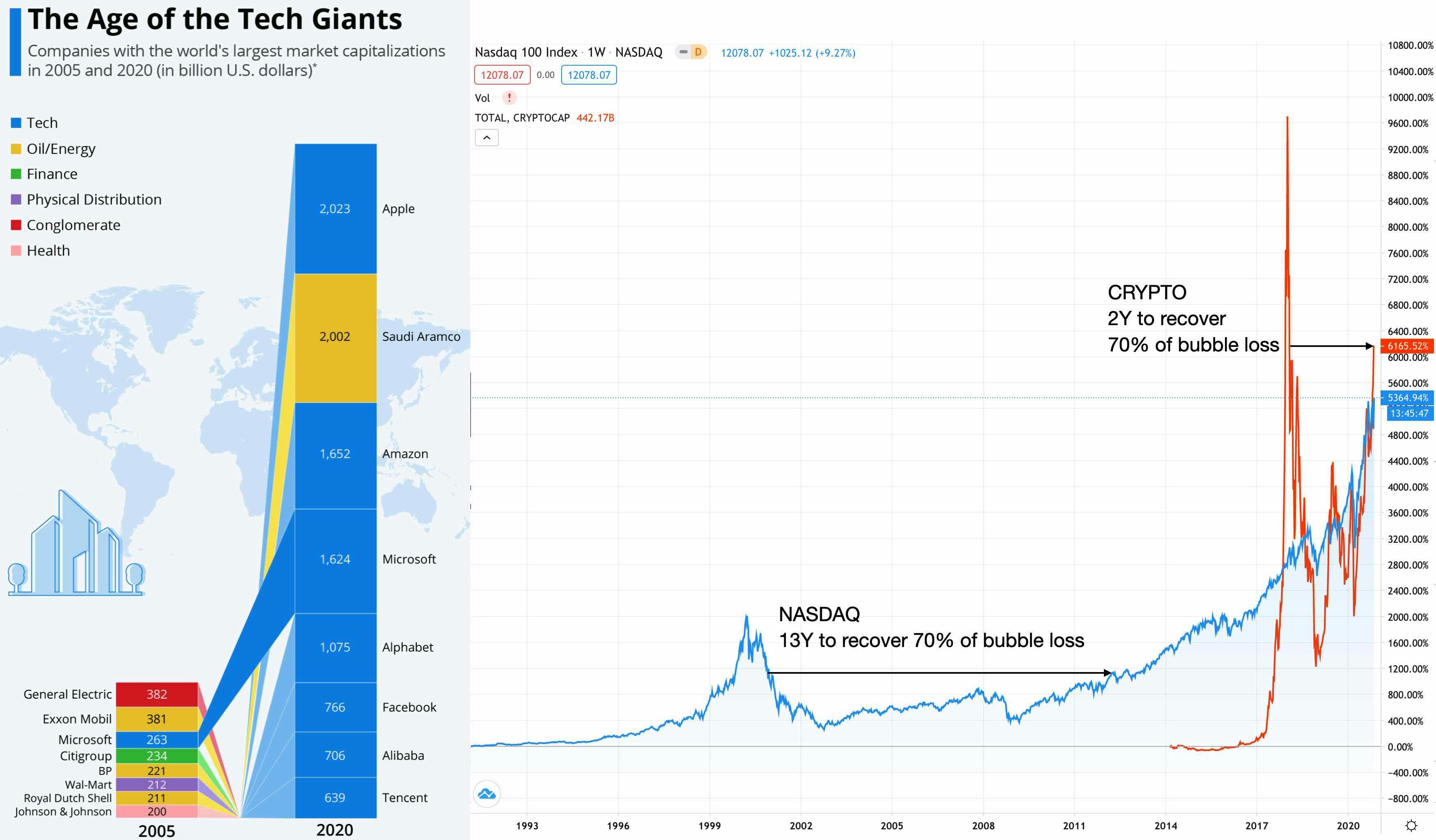

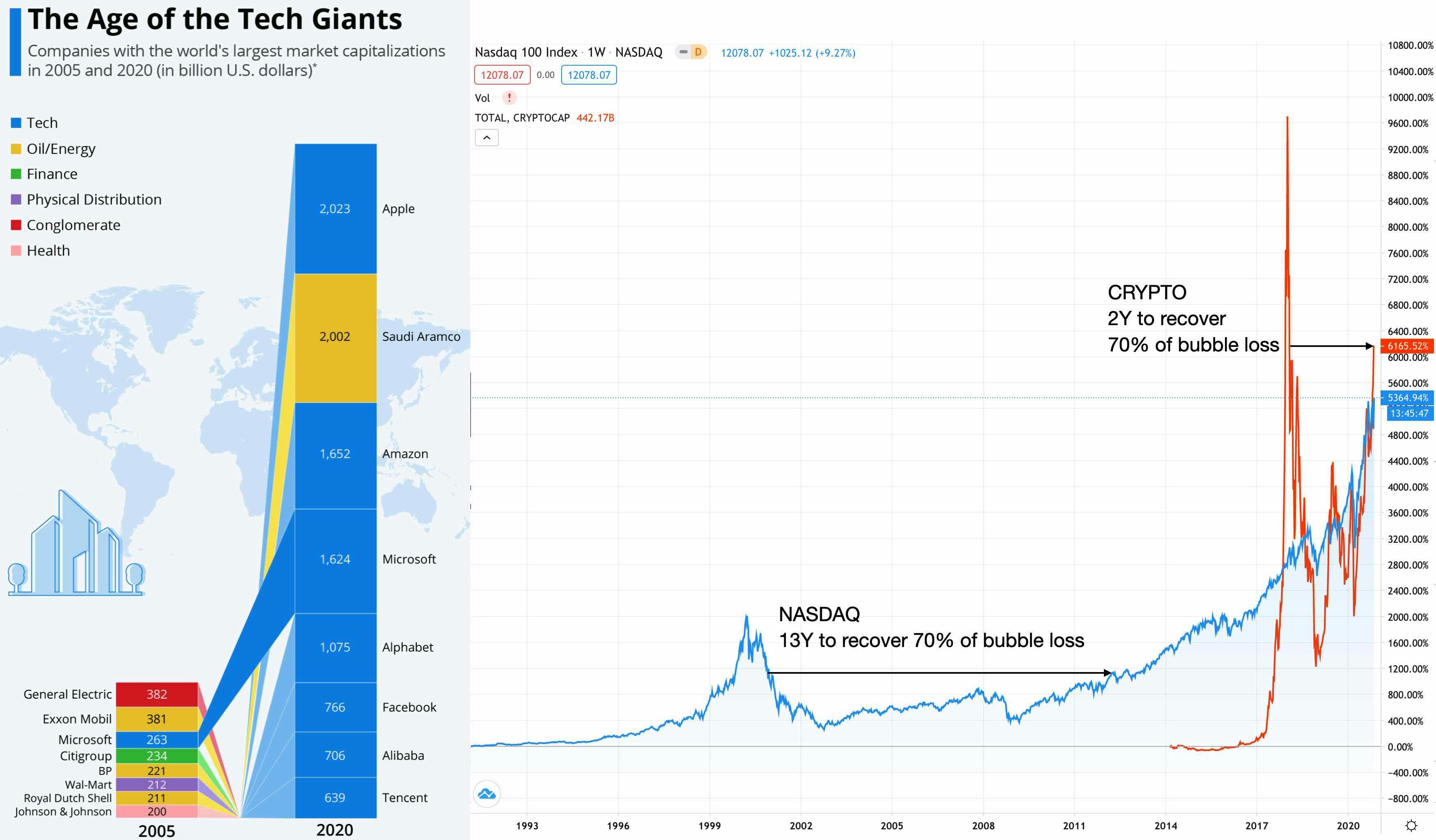

Thousands of crypto startups failed. That is normal for VC market and comparable with dot com bubble. It took 15 years to recover investments for average investor into tech companies index. Most of the companies which were in this index back to 2000 are bankrupt, few rule the planet today.

Blockchain outperforms internet. Crypto capitalisation recovered 50% of the bubble decline in 2 years comparing to dot com bubble’s 12 years for corresponding recovery.

However, scale of people involved and lack of regulation facilitated greater number of scums, shareholders and teams’ conflicts, and blackmailing.

Blackmailing attacks are designed to impair clients or team relations are the norm here to force startups to pay to blackmailer. We do not pay.

Would you invest in a person who would likely to flee at any moment due to negative news?

We prefer to check her “immunity” to conflicts and ability to leverage pressure and constructive conflicts for growth, creativity and performance.

In New Orlean (mid 19th), you would not find job or get a loan or marry to yellow fever. Companies were loath to train an employee who might succumb to an outbreak. Fathers were hesitant to marry their daughters to husbands who might die. You should get diseased with yellow fever (50% chance to die that time) in order to get the immunity needed to become a real citizen.

High load capital markets and bubble scandals enables us to leverage brutal feedback. The main goal of such feedback is to ensure that adequate performers do not cover each other to protect their comfort status quo at expense of clients and top performers.

They should either to grow into top performers who challenge each other to grow and perform, instead of covering each others’ lack of competence and effort. Otherwise adequate performers should go to legacy companies where such behaviours flourish.

If one violates our we give an immediate public feedback. If person leverage the feedback to change - he could become a great teammate. If her is trying to defend herself with growing fake statements and backtalk (to prevent backtalk defence strategy we, like Netflix, fire for both backtalk and failure to report backtalk) - we want to see it on her first week.

Thus comfort with pressure is a must. And we leverage it for

Learn more from one of the most detailed in the world Startup Culture Deck:

Want to print your doc?

This is not the way.

This is not the way.

Try clicking the ··· in the right corner or using a keyboard shortcut (

CtrlP

) instead.